Masimo Sells Sound United to Harman/Samsung, Creates Audio Empire?

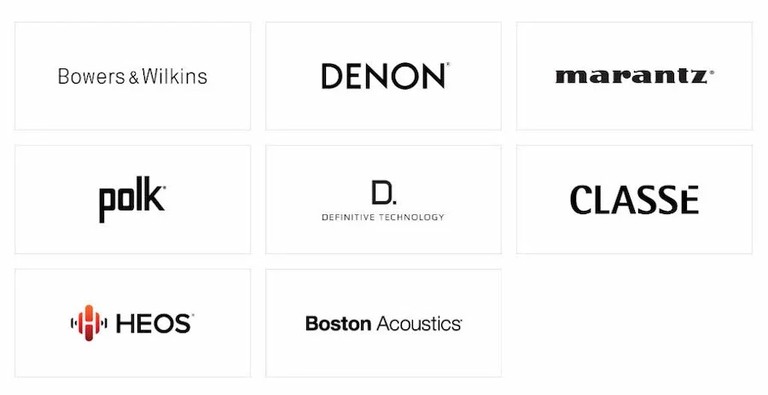

The deal that we’ve cautiously anticipated for a year has finally been confirmed. Medical technology company Masimo will end its unexpected detour into home audio by selling its Sound United brands to Harman. All the legendary brands Masimo purchased back in 2022 for $1.025-billion, including Denon, Marantz, Definitive Technology, Classe, Polk, HEOS, Boston Acoustics and Bowers & Wilkins will join other legendary Harman hi-fi audio brands like Harman Kardon, AKG, JBL and a list of that could continue for several more lines. Harman and Masimo have agreed to the sale at a relative bargain price of $350-million, the deal is expected to close by the end of 2025, making Harman an absolute juggernaut in both home and car audio.

We last reported on Masimo in April 2024, when the medical supply company had cordoned off its consumer division into a separate company, called Masimo Consumer that includes but is not limited to its audio brands. We suspected then that it might be in preparation for a sell-off, at least of its audio brands that came in under Sound United. Prior to buying Sound United, Masimo had planned consumer medical monitoring devices with Masimo's W1 smartwatch released just months after its Sound United acquisition.

Masimo Consumer and Masimo were both run by then CEO, Joe Kiani, the engineer who originally founded the business. Creating a separate Masimo Consumer business was a practical way to protect Masimo proper’s shareholder value by divesting it of its less profitable consumer business. Supplying hospitals with medical equipment almost certainly deals in higher profit margins than just about anything consumer-facing. So, you can imagine some amount of consternation among the Masimo board for expanding into any consumer business, let alone instantly becoming one of the largest home audio manufacturers for a cost of one billion dollars.

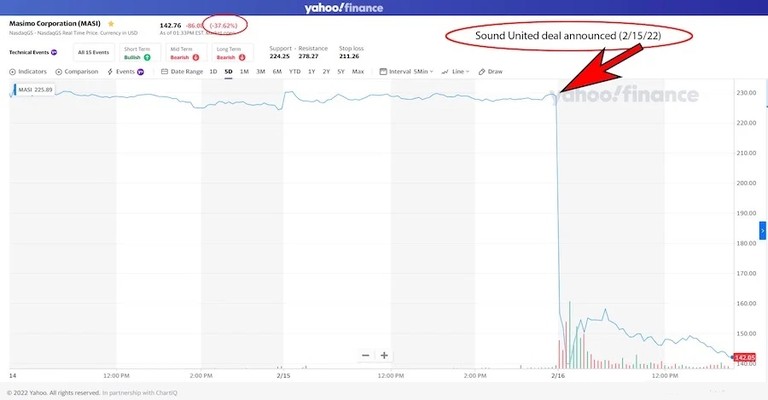

You would have imagined correctly if you anticipated a stock plummet after Masimo purchased Sound United in 2022. Masimo lost 40% of its value the very next day.

The Sound United sale to Harman marks the end of a Masimo saga that involved a protracted power struggle between founder/CEO Joe Kiani and an “activist investor” faction led by Quentin Koffey that, among other things wanted Masimo out of the audio business. Today Koffey is sitting Vice Chairman of Masimo’s Board of Directors. In a statement after the Sound United purchase, Kiani extolled the benefits of Sound United's established global distribution network that would help drive its own consumer medical business. The opposing faction disagreed. Kiani’s high-profile legal entanglements with Apple over allegations that its Apple Watch infringed Masimo patents didn't help bring zen-like calm to Masimo's board either. Everyone loves a good David vs. Goliath story. But when the Goliath is Apple, nobody wants to be David.

Months after the split that created a separate Masimo Consumer business, Joe Kiani stepped down as CEO, the result of a shareholder vote in late 2024. The changes within Masimo to follow were significant, one of which was the fulfillment of a promise to sell the Sound United audio brands.

Leaving as Masimo CEO

It’s sad to learn a business's founder and admitted audiophile, Joe Kiani going the way of Norman Osborn as company founders voted out of their business by investors. But Kiani is no Green Goblin. I imagine him as more of a Bruce Wayne or Tony Stark-like figure. A brilliant, wealthy industrial engineer possessing a keen inventiveness with wearable gadgets. I thought it was only a matter of time before we began hearing about the Masimo-signal lighting up the night sky over Irvine California. But through his research, creating a company and a charity that began the Patient Safety Movement, I have no doubt that Joe Kiani’s work has saved lives, even if he didn’t have to rappel from rooftops to do so. We can have no way of knowing if Kiani was onto something as he expanded Masimo into audio. But any company focusing on its core competency is never a bad idea, and for Masimo that means emphasis on medical equipment and selling off Sound United.

How I imagine a founder being voted out by investors, but I'm sure Kiani faced it in a much more dignified manner.

According to analyst at Strata-Gee, Ted Green in an April 2025 article about Masimo's recent SEC filing he describes a transformed company under the leadership of new CEO, Catherine Szyman. Putting its power struggles in the rear-view, Masimo appears to be entering a new era of transparency for investors and re-calibrated focus on its core business. The SEC filing also outlines rebounding sales for Masimo Consumer's medical devices and even a discretionary bonus for the Head of Masimo Consumer, COO Blair Tripodi. So, it would appear that Masimo Consumer will live on, even if in silence without audio companies. It would be easy to believe the rebound in sales may have included the Sound United brands as well. I'd expect the audio industry has fully recovered from the supply disruptions brought on by the pandemic years, even if manufacturers are entering a new round of supply chain disruptions, though oddly brought on by politician's efforts to expand American manufacturing.

One observation made by Green's April article about Masimo's SEC filing led him to predict a Sound United sale was imminent because the company had categorized the audio brands as a “discontinued operations”. Now we know, a sale to Harman was likely already in the works.

Press Statements From Masimo Top Brass

Quentin Koffey, Vice Chairman of Masimo’s Board of Directors said, “Finding the right home for this business has been a stated priority of the new Board from day one, and this transaction represents an important milestone as we continue to position the Company to achieve our goals of accelerating revenue growth while delivering disciplined margins. Masimo has tremendous opportunities ahead and we are confident we have the right healthcare-focused strategy, experienced leadership team and culture of innovation in place to build on our significant positive momentum.”

Katie Szyman, Chief Executive Officer of Masimo, said,

“Since I took over as CEO, a key objective has been refocusing our business to ensure we are allocating time and resources to areas of unmet clinical need and driving growth and operational efficiencies. This transaction aligns with these objectives. Our consumer audio business and its talented team will be well positioned for growth and success under HARMAN’s leadership.”

Blair Tripodi, Chief Operating Officer said:

“Masimo has entered into an agreement to sell its Sound United audio business to HARMAN, marking an important milestone. This transaction reflects the company’s commitment to restoring focus on the core healthcare business, while enabling our industry-leading audio brands to continue to thrive. We are confident that HARMAN will help build on the strong foundation of the Sound United brands. The sale is subject to regulatory approvals and other customary closing conditions, and we will provide updates as soon as we are able as the process moves forward.”

Conclusion: Harman Becomes the Biggest Conglomerate in Audio

Audiophiles worldwide may appreciate Masimo giving the Sound United audio brands what appears to be a soft landing with Harman. It could have been so much worse! Taking a $650-million dollar haircut on the initial investment is no small consideration. I like to think Masimo did the best it could for the business.

But now, can we find anything concrete about the future of the Sound United brands from the distilled corporate statement directly from Harman?

Dave Rogers, President of HARMAN’s Lifestyle division, said,

“This acquisition represents a strategic step forward in the expansion of HARMAN’s core audio business and footprint across key product categories such as Home Audio, Headphones, Hi-fi components, and Car Audio. It complements our existing strengths and opens new avenues for growth. Sound United’s portfolio of world-class audio brands including Bowers & Wilkins, Denon and Marantz, will join HARMAN’s iconic family of brands, including JBL, Harman Kardon, AKG, Mark Levinson, Arcam, and Revel. Built on a shared legacy of innovation and excellence in audio technology, this combined family of brands, together with the talented employees of both companies, will deliver complementary audio products, strengthen our value proposition and offer more choices to consumers.”

Key phrases used by Rogers:

“...a strategic step forward… new avenues for growth… strengthen our value proposition… more choices to consumers.”

It’s tough to extract meaning or intent from a press statement that’s been polished by layers of marketing and legal teams. Optimistically, we could say that words like “strategic” and “growth” suggests intent to invest rather than consolidate. Lines about “strengthening the value proposition” and offering “more choices” could be read as signals that Harman may seek opportunities to broaden the brands’ reach, rather than trimming them down for greater efficiency.

Home audio is in a tricky place, some may call it a

decline, but it’s more of a shift. We’re seeing audio categories

blur as the industry converges into other technologies: App ecosystems, connected

mobile devices and whole home, multi-room smart-setups. Harman (and Samsung) has great potential with both the reach and resources to

keep these brands on the bleeding edge of wherever audio goes next.

Home audio is in a tricky place, some may call it a

decline, but it’s more of a shift. We’re seeing audio categories

blur as the industry converges into other technologies: App ecosystems, connected

mobile devices and whole home, multi-room smart-setups. Harman (and Samsung) has great potential with both the reach and resources to

keep these brands on the bleeding edge of wherever audio goes next.

I consider it a good outcome to see Sound United falling into the hands of an experienced audio company that understands the technology and has an incentive to increase each brand’s value. The dramatic expansion of Harman and Samsung creates an audio-video technology powerhouse, perhaps bordering on too powerful. The new Harman may hold a near monopoly on home and car audio, but it’s not one that can sit still. Audio/video and its convergence with nearly any other technology creates a market where smaller competitors are liable to shake the milk money out of any big company that ceases to innovate.

Gene DellaSala's opinion is a bit more pragmatic and cautionary. He worries that Harman could become too dominant in the industry, potentially displacing many of the boutique, privately owned audio companies we know and love. He’s also concerned about the Sound United brands maintaining their unique identities and respective sonic signatures. Bowers & Wilkins has a distinctive sound and appeal that a loyal fanbase adores, and DellaSala believes it is important to preserve.

But I’m glad we didn’t hear about Sound United being butchered and sold off to private equity. To many of us, these audio brands aren’t just “brands” the way Tik-Tokers consider themselves a brand harassing people on Tokyo subway systems. These are respected names with a history in many of our lives. Seeing Harman Kardon now connected to Marantz and Bowers & Wilkins all in one company completes a circle of my own formative years of learning about and enjoying hi-fidelity sound.